Cash Management

Stay ahead of the game and keep everything under control with Fluentis ERP's Treasury Management

Fill out the form to request information

Corporate Treasury and Cash Flow Management

Know the financial situation of your company at any time

The Fluentis ERP’s Treasury Management area provides powerful tools to monitor vital parameters for every company’s life, such as Cash Flow (Cash Flow) and exposure to credit risk towards customers.

For the management of these essential data, it seamlessly integrates with the Administration area, reading data from it and also with the Purchasing, Sales, Job Account, and even Production areas.

It supports the Administration area, particularly Accounting, with various current management procedures for bank flows that allow automation and speed in both communication with banks and the accounting of operations.

Modules and FeaturesDashboard and Real-Time Insights

Cash flow calculations can also be graphically represented through preloaded dashboards.

You can customize and create dashboards according to your preferences using the dedicated designer tool.

Using the dashboards is incredibly intuitive. By adjusting the master graph, such as the timeline to narrow down the period of interest, the other graphs are recalculated in real-time.

The data can be presented in various types of graphs, including pivot tables, dashboards, histograms, pie charts, and more.

Detailed Cash Flow Analysis

Automated processing with just a few simple clicks.

Projection of a freely configurable six-month cash flow scenario.

Summary by type of financial flow with the possibility of detailed exposure of each flow.

The ability to manually add off-book due dates to supplement and adjust the processing.

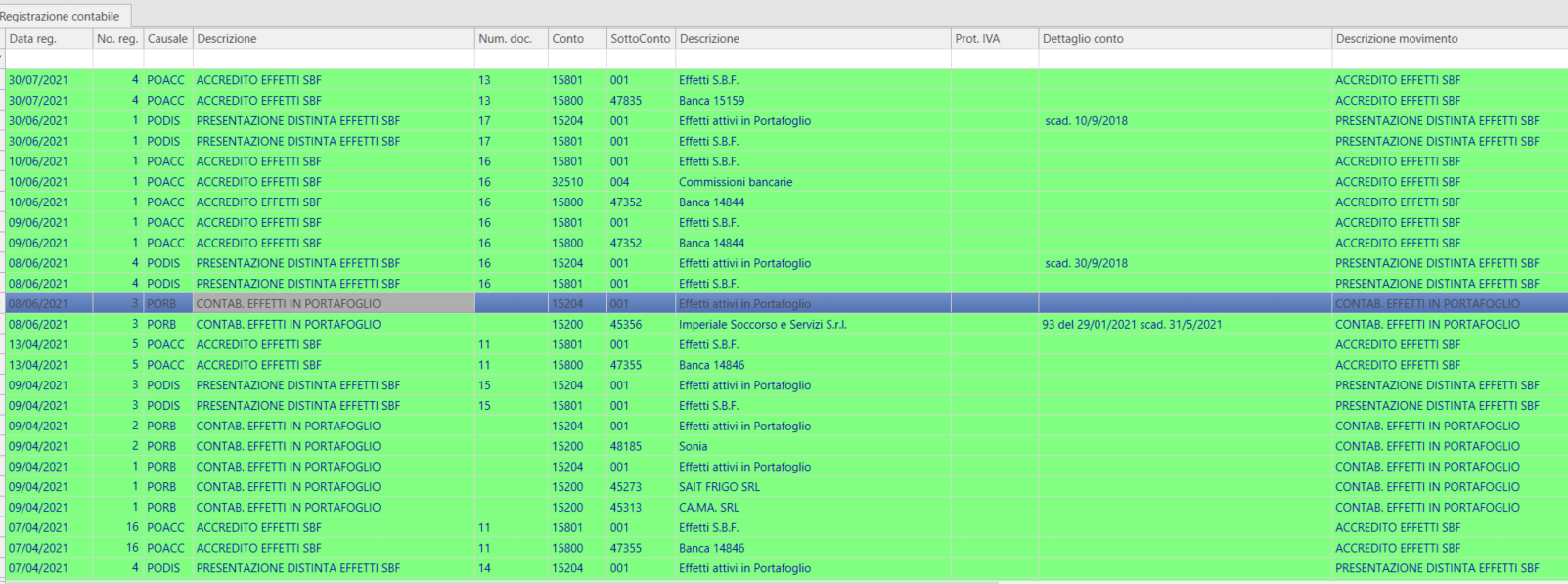

Automated Portfolio Entries

The management of the active portfolio, with its various variables concerning the presentation of bills of exchange or bank receipts, is completely automated. Not only is the creation of active bills of exchange or bank receipts done automatically by reading open items or active invoices, but also the complex series of accounting entries required for accurate recording is processed automatically.

In the case of corrections or cancellations of transactions, it is possible to access restoration procedures that automatically revert the situation to previous states (before presentation or issuance of the bills of exchange).

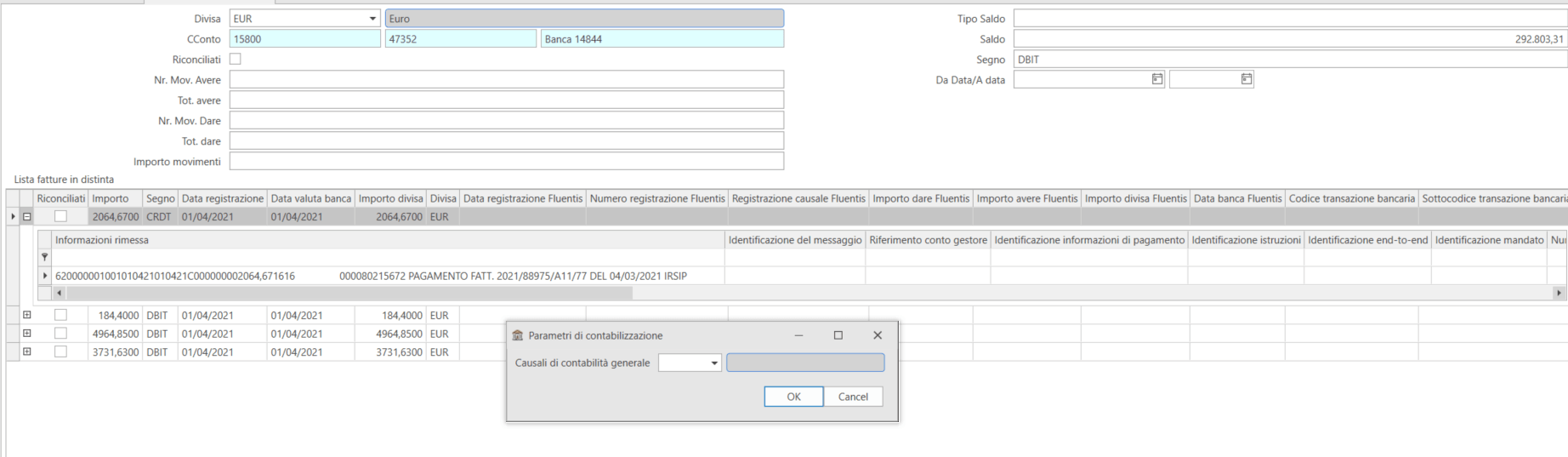

Reconciliation or bank accounting? All automatic

This feature, particularly the automatic creation of accounting entries from current account movement lists, completes the accounting automation, effectively making manual entry of journal entries a residual method.

Automation, in fact, covers both active and passive billing, as well as receipts and payments, and even the management of the active portfolio. Other types of automation can also occur, for example, by importing accounting entries related to employee payrolls processed by the labor consultant in .csv format.

What our customers say about Fluentis

With Fluentis ERP, we can manage all our business processes with a significant improvement in management and performance analysis. This allows us to be more responsive to market demands internally. In the industrial sector, the ability to design our processes and workflows, even independently, and collect field data for a detailed analysis of project margins has been fundamental.

- Cristina Guaitolini, IT Manager

SGM Magnetics

Cash Flow

The module allows reading data from the Administration, Purchases, Sales, Job Accounting, and Production areas and, starting from the reading and representation of the Cash and Bank account balances, it can provide a Cash Flow forecast for six months (or for any selectable future six due dates). The management of the specific types of documents to consider is highly customizable to create different analysis and forecasting scenarios.

Automatic Cash Flow Generation

The generation of Cash Flow situations is extremely simple and can be performed with just a few clicks.

Extra-Contabili Due Dates

The situation calculated automatically can also be supplemented by entering manual movements to account for financial sources and commitments not detectable from the existing system data.

Cash Flow Analysis Printing

This feature allows you to quickly print the cash flow projection for the next six months, which is immediately accessible and easy to understand.

Liquidity Management

A procedure that enables the analysis of the various bank account situations and the proper management of payments to prevent financial shortfalls. It can be subjected to a specific authorization process.

Advances and Receipts

The module is specific to managing the presentation of invoices at the bank for advances. It handles the relevant accounting entries for the subsequent collection in an automated way.

Learn More

- Creation of advance invoice lists and acquisition of due dates from sales invoices.

- Accounting for the presentation of the invoice list at the bank.

- Accounting for the final collection from the customer.

Payment Orders for Suppliers

This module allows you to create payment orders (e.g., wire transfers) to be sent to the bank in .xml format directly from open items. The orders can then be processed for accounting purposes, automatically closing the open items and creating the corresponding accounting entries.

SEPA Format Payment Orders

This module manages valid formats for both domestic and international payments, supporting both wire transfers and pre-authorized debits (SDD – Sepa Direct Debit).

Blocking of Open Supplier Items

You can choose to block and unblock payments to suppliers, subjecting this functionality to authorization rights and workflows.

Automatic Creation of Supplier Payments

It includes a wizard for quick and mass creation of payments and their related accounting entries.

Payment Destination Planning

You can schedule and define the banks to which various outbound payments are to be directed, providing valuable information for due date schedules and your company’s cash flow.

Import of Passive RIBA Notices

This module allows you to import passive RIBA (Bank Receipt Notice) notices and link them to the relevant supplier items for confirmation, and create the payment file to be sent to the bank.

Bills and Bank Receipts Portfolio

This module allows you to manage the issuance of various types of financial instruments, such as bills of exchange, as well as bank receipts, and proceed with bank presentation, safekeeping, and subsequent collection. All related accounting entries are automatically generated.

Acquisition of Financial Instruments from Invoices

It enables the automatic generation of financial instruments and bank receipts by reading sales invoices in the database, even if they have not yet been accounted for.

Acquisition of Financial Instruments from Open Items

This feature allows you to automatically generate and account for financial instruments and bank receipts by reading open items in the database.

Import of Outstanding Items

You can import a list of outstanding items reported by the bank directly through the specific electronic file format.

Creation and Accounting of Presentation Orders

This module allows you to manage different types of presentation, from safekeeping to post-collection, and monitor the presentation matrix in a differentiated form by presentation type. It also automatically manages any bank fees and commissions.

Management and Accounting of Instrument Collection

Automated accounting entries are created during the instrument collection process, including the handling of any bank fees or commissions.

Creation and Accounting of Outstanding Items

Outstanding items can be managed at any stage of the life cycle of the financial instruments and bank receipts, from the item in the portfolio to the “safekeeping” presentation or for sums that have already been collected. Automated accounting entries will reverse the appropriate account, reopening the customer’s position and related open items.

Mass Creation of Outstanding Items

A wizard for the mass creation of outstanding items is available for your convenience.

Accounting for Transfer of Bills to Suppliers

This procedure allows you to manage the transfer of financial instruments in payment to a supplier and generate the necessary accounting entries.

Accounting for Outstanding Items on Assignment

Outstanding items that arise from financial instruments assigned as payment can also be managed automatically.

Bank Current Accounts

This module allows you to import electronic formats of bank account movements from your Corporate Banking channel. You can then perform a reconciliation (either manually or automatically) with the accounting entries already present in the database or generate accounting entries automatically.

Learn More

- Import Movement Lists

- Automatic creation of accounting entries from bank movement formats

Manual Bank Reconciliation

To reconcile a specific movement, you can open a search mask that’s pre-filtered according to the bank’s accounting account and related dates. You can then select the accounting entry to reconcile.

Automatic Bank Reconciliation

The system can automatically reconcile bank movements with accounting entries based on specified criteria (e.g., matching dates or amounts).

Customer Risk Management

This module helps you monitor exposure to customers by tracking granted credit limits, generating alerts, and locking user-generated commercial documents pending authorization. The authorization process can be configured with workflows for notification, request, and authorization release. Several panels are available for monitoring useful indices to study credit turnover, average delay in customer payments, overall and per-customer exposure levels, and other valuable information.

Lock Manager

This primary panel, which can be subject to selective access rights, manages authorizations for exceeding granted credit limits or blocking supplies to specific customers in advance.

Remittance Control

This panel allows you to check average delays in collections.

Customer Exposure

This panel highlights the overall exposure to risk and the situation for each customer.

DocFinance

The DocFinance module, designed for those with advanced treasury management needs, includes configurations to export the chart of accounts and ledgers to DocFinance. It then allows for the automatic import of accounting entries related to the bank through Bizlink.

Piteco

With the Piteco module, it provides configurations to send provisional payment transactions to this treasury software and then import the confirmation file externally via Bizlink.

Discover how Fluentis ERP

can transform your business

15-day free trial | No automatic renewal | Instant access

Contact us for more information

Get in touch with us if you:

- Are a SMB in Manufacturing, Distribution, or Services

- Need to streamline and digitalize your business processes

- Want to take advantage of the benefits of a native cloud solution

- Want to replace your non-integrated softwares with a unified ERP platform

+1 281 404 1726

Chat with us