Accounting & Finance

Monitor processes for efficient accounting management

Fill out the form to request information

Efficient Accounting & Finance management are at the core of business growth.

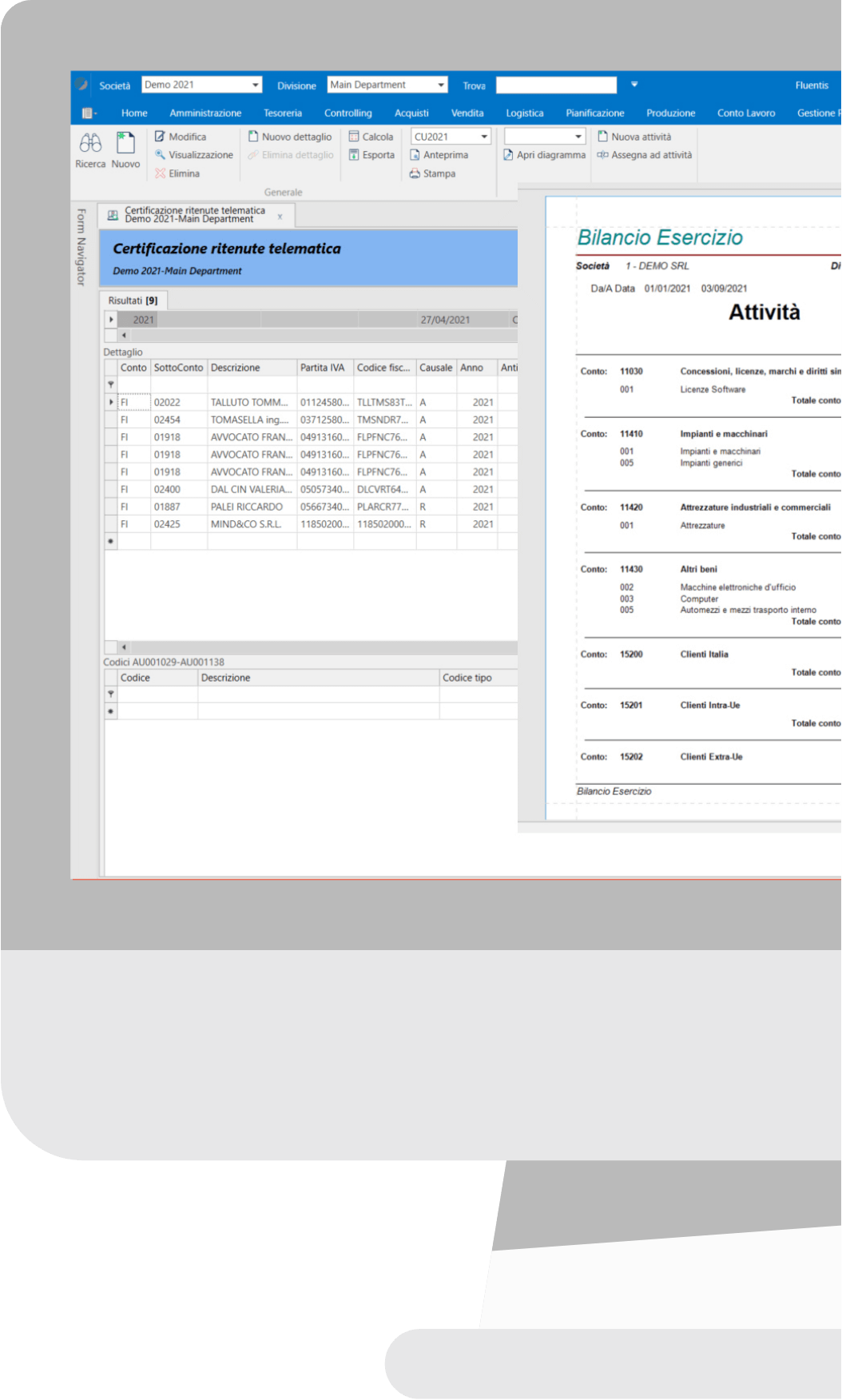

Get an overview of the company, in addition to tax compliance management

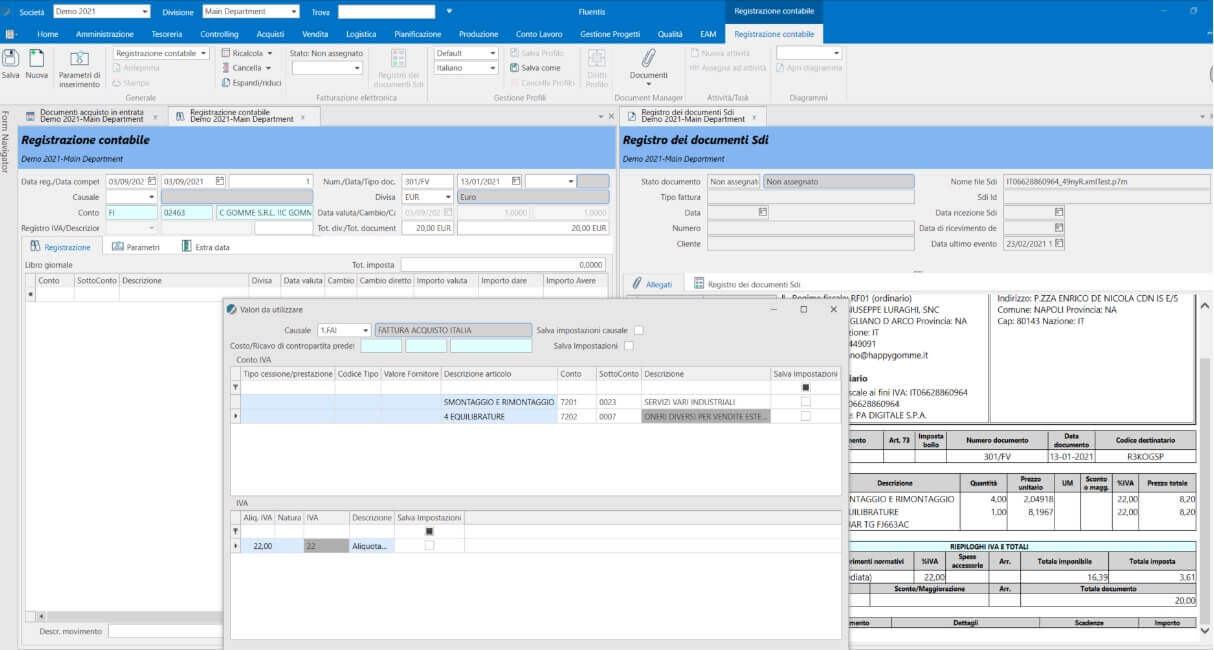

The Accounting & Administration module of Fluentis ERP simplifies daily financial operations, providing all the essential tools for managing accounting records, generating financial statements, and ensuring seamless tax compliance—all within a single, intuitive platform.

Furthermore, Fluentis ERP offers a comprehensive suite of accounting and administration features, including asset management, lease tracking, and passive mortgage management. For businesses operating internationally, the system streamlines compliance with automated Intrastat reporting and other tax obligations related to cross-border transactions.

At Fluentis, our expert Analysts continuously track the latest trends in accounting and financial management, ensuring our software stays ahead of evolving US regulatory standards. With proactive updates, you can focus on growing your business while we keep you compliant and competitive.

Modules and FeaturesThe strengths

Integration with electronic invoicing and automatic generation of accounting entries.

Complete and automated management of foreign currency transactions.

Logic based on freely configurable accounting reasons to define your own accounting schemes.

Deep integration with other business modules.

Take control of your Business Strategy

Automated Processes

Automated processing of adjustment entries, depreciation, accruals and deferrals, and annual account closing and reopening transactions.

Foreign Management

Complete and automated management of foreign currency operations with automatic exchange rate updates, handling differences, and an integrated year-end detection procedure to be included in the financial statements.

Highly Configurable

Logic based on freely configurable accounting reasons, allowing you to define your own accounting schemes for use in automatic accounting procedures or as a template, which can be modified as needed.

Easily exchange

data with your

accountant

Simplified tax compliance management

Fluentis allows you to independently process and send all necessary documents or rely on your accountant’s support.

Export of telematic files

Thanks to the Bizlink component, you can automatically export all the telematic files required for submission to your accountant or the relevant authority.

Import of employee payroll data

With Fluentis, importing your employee payroll data is a simple and quick operation, enabling you to generate the corresponding accounting entries automatically.

Limitless business management

Intercompany Management

Simplify and expedite the replication of common data between one company and another (chart of accounts, master data, invoices, etc.) with the ability to define and transform data during the transfer (e.g., a sales invoice for company 1 can become a purchase invoice for company 2). Thanks to integration with the Management Control module, it’s also possible to process consolidated financial statements by adjusting intragroup operations.

Multi-Company

Concurrent management of multiple companies and business divisions (business branches that can be filtered), without limitations in number, always online, simultaneous operation for easy data comparison. Import accounting data via Excel with simple predefined templates; fill in the spreadsheet and import chart of accounts, master data, open items, and other accounting data independently.

Special Management

Automatically generate accounting entries

Deep Integration with other Business Modules

Discover all the features of integrated accounting management

In Fluentis ERP, the area dedicated to Accounting and Administration Management is fully integrated with Cash Management, Accounts Payable and Receivable, and Management Control.

The modules of the Purchase and Sales cycles communicate by sending data and allowing for the automatic creation of accounting entries, directly from sales and purchase invoices.

Downstream, accounting data is automatically integrated and flows into asset management, customer and supplier deadline management, analytical accounting (with maximum flexibility in defining cost centers), project management, and also treasury and finance management, where they form the basis for a completely automated processing of company cash flows and credit risk exposure monitoring towards customers (average payment delays, unpaid debts, and credit limit restrictions).

Within the Fluentis Accounting Management area, specific functionalities for managing consultants, sales agents, and professionals (recipients) are also included, covering all administrative and tax compliance requirements.

What our customers say about Fluentis

Fluentis is an interconnected management system across business functions, allowing data sharing by areas and expertise. It encourages the consolidation of a team spirit with awareness and responsibility, as each task assigned to users is necessarily a prerequisite for subsequent activities, ensuring the proper functioning of the company in accordance with its policies.

- Mr. Francesco Lacquaniti, Administrative Director

A. Cesana Srl

General Accounting

The module allows complete general accounting management and offers various automations in the pre-balance adjustment phase and annual account closing.

Accounting Entries

- Possibility to record first-entry entries using predefined entry prototypes.

- Simultaneous management of open items to feed customer/supplier deadlines with control mechanisms to prevent differences and inconsistencies compared to accounting transactions.

- Automatic adjustment entries, accruals and deferrals, automatic account closing and reopening.

- Automatic management of exchange rate differences for foreign currency transactions.

Accounting Reports

Simplicity in searching for accounting and VAT entries and the ability to extract them as desired in various available prints. Some of the main available reports include:

- Account statement

- Verification balance

- Annual financial statement

- Printing of the accounting journal

Account Statements

They can be printed on paper in traditional reports or viewed on the screen for greater interactivity: quick preview of the entry by expanding the row with + or editing with a simple double click.

Tax Declarations

Open Items

- Allows simultaneous creation and closure of open items alongside accounting entries.

- It allows free creation of extra-account open items as well.

- It has various prints for deadlines and customer/supplier situations.

- Overdue items can be automatically used to create payment reminder letters for delayed customers, and the sending of letters by email can be fully automated.

- Open items and their payments can be organized into groups to support even the most complex installment or fractional collection/payment situations.

- It is possible to manage agent commissions in the accounting module (as an alternative to procedures available in the Sales area) by directly reading accounting entries and using a particular “payment fully received” maturation logic among others.

- There is an automated management mode for open items created from Customer and Supplier Orders/Delivery Notes for immediate payment/at delivery, with automated management of the related advance invoice.

- A guided procedure is available for reconciliation between open items (advance invoice/final invoice or Customer/Supplier).

Automatic Account Closing/Opening

It allows for automated year-end account closure and reopening, and automatically reopens the accruals and deferrals generated by adjustment entries and carries out the transfer of the calculated profit or loss.

Adjustment Entries

Automated processing of adjustment entries such as active/passive accruals and deferrals, calculation and accounting of asset depreciation quotas, year-end account closure and reopening.

Temporary Registration

Accounting entries can be saved in temporary mode and then converted into final entries, including mass conversion via the appropriate procedure.

Currency Regularization

The guided procedure allows for automatic allocation and accounting of year-end exchange rate differences on foreign currency-denominated accounting balances (customers, suppliers, cash, bank). It integrates with the management and automatic updating of exchange rates in Fluentis.

Analytical Accounting Management

Analytical accounting management serves as the foundation for comprehensive management control that also integrates production data. It is based on a modern multidimensional management of cost centers, which can be freely aggregated in various combinations for multiple levels of analysis.

Business Centers

Automatic valuation of cost/profit centers (referred to as “business centers” as they can be used in both sections as modern controlling requires) and projects thanks to the links that can be predefined in the chart of accounts.

Analysis Dimensions

Dimensions allow you to define an unlimited number of business center aggregations for different analysis purposes. For example, alongside the main set of cost centers that define the total costs of the company, you can define a parallel dimension, which is automatically updated by the same accounting transactions. It can include centers dedicated to monitoring the costs of a particularly significant investment or a specific business branch.

Cost Drivers

Cost drivers provide maximum freedom and flexibility in allocating common costs to business centers created to accommodate direct industrial costs or transfers from auxiliary centers to production centers. There are several attribution or allocation logics, and it is possible to define the priority with which different cost drivers are processed. The logics can vary depending on the analysis area; for example, attribution and allocation may follow different logics between the budget and the actuals.

Analytical Accounting Reports

These reports provide an initial, quick overview of business center movements and results, and their connection to accounting transactions, without further processing. When movements in analytical accounting are captured and processed by cost drivers and integrated with data from production, additional final reporting can be generated to reconcile and analyze the final results.

IV Directive Balance

This module, included in Fluentis Accounting Management, leverages powerful features for reclassifying accounting data, allowing for the flexible definition of a data reclassification model. It also benefits from a preloaded model that reflects the regulatory structure of the balance sheet in accordance with the IV Directive of the European Union (Civil Accounting).

Accrual Basis Balance Sheet

Reclassification of accounting data is supported by a flexible function for processing periodic account closures with related adjustment entries. Multiple closures can be processed, even for sub-annual periods, without interfering with general accounting transactions. This allows for the preparation of not only a balance sheet according to the IV Directive of the EU but also any other data reclassification for management purposes.

Reclassification Models

Reclassification models can be defined by the user and allow for the display of both accounting and cost center data, with various aggregations and formulas such as sums, quotients, additions, and subtractions.

Assets

The module ensures the proper maintenance of the amortizable asset register and asset cards, as well as a high degree of automation in calculating and accounting for depreciation. The procedures for purchasing new assets and disposing of, destroying, and revaluing them are perfectly integrated with the relevant accounting entries, allowing for the automatic recognition of gains and losses.

Learn More

- Automatic update and creation of asset cards during the accounting registration of purchases, disposals, destruction, etc.

- Automated depreciation management with the option to manage incremental assets using different logics.

- Legal revaluations management and printing of the relevant statement.

- Complete management of mandatory prints such as asset cards and asset registers.

- The ability to simultaneously calculate an objective depreciation, valid for Management Control purposes, with logic not related to taxation but functional to the actual use of the asset. In the Controlling area reporting, reconciliation between the two calculation criteria, administrative and objective, is always possible.

- Management of tax credits for super/hyper-depreciation.

- The ability to develop Amortization Plan simulations for the next 10 years with alternative percentage applications.

Recipients

This module, included in Fluentis Accounting Management, allows for the management of a particular type of suppliers represented by professionals and sales agents. They are subject to withholding tax and other forms of pension contribution and typically issue advance invoices that need to be managed appropriately.

Learn More

- Management of provisional invoices and easy conversion to final invoices for automatic accounting.

- Management of compensation for net or gross items.

- Interaction with the sales agent commission calculation module through the procedure that transforms commission settlements into agent compensation (provisional invoice).

Intrastat

This module in the Fluentis ERP Accounting Management area allows for the automated creation of Intrastat listings based on the invoices in the database or accounting records.

Scopri di più

It handles Intra1-2 in sections bis, ter quater, quinquies, and sexies. It is possible to export the electronic file for both Intraweb (Customs Agency) and Entratel (Revenue Agency) applications and send them autonomously.

Tax Declarations / Communications

Learn More

- Periodic and annual settlements

- Electronic communication of settlements

- Management and printing of registers

- Regular and “mobile” habitual exporter limits

- Export of ABI tracks for bank receipts

- Automatic processing and sending of self-invoices for foreign purchases to the SDI

- Preparation of electronic withholding tax certificates

Leasing

This module in the Fluentis Accounting Management area allows for the comprehensive management of leasing contracts, from entering and managing amortization schedules to all necessary accounting entries, including year-end adjustments.

Learn More

- Automatic amortization schedule calculation based on contract key data such as asset value, interest rate, collection and management fees, and residual value.

- Automatic accounting for the initial maximum lease payment and periodic lease payments.

- Automatic calculation and accounting of the year-end maximum lease payment adjustment, taking into account the daily cost.

Passive Loans

The Passive Loans module allows for the management of passive loan amortization schedules and the automatic accounting of installment payments.

Reminders

The Reminders module allows for the identification of overdue open items and the generation of payment reminder letters to customers. Reminder letters can be generated automatically in different versions of text and can include various detail parameters.

Learn More

- Standard text parameterization of reminder letters, also available in multiple languages.

- Electronic communication of settlements

- Automatic generation of reminder letters with different text versions linked to the customer type.

- Automatic printing of the generated reminder letter.

- Possibility of mass mailing of letters through a workflow.

Discover how Fluentis ERP

can transform your business

15-day free trial | No automatic renewal | Instant access

Contact us for more information

Get in touch with us if you:

- Are a SMB in Manufacturing, Distribution, or Services

- Need to streamline and digitalize your business processes

- Want to take advantage of the benefits of a native cloud solution

- Want to replace your non-integrated softwares with a unified ERP platform

+1 281 404 1726

Chat with us